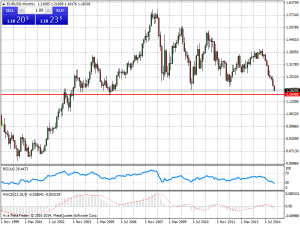

EUR: After a first impulse up to 1.1436 following the break of the triangular pattern, a pull back could be developing based on 1.1260/80, trend line, map bottom, moving average value and reference to keep going the euro recovery towards 1.1600.

JPY: Choppy consolidation range sessions between 122.45 and 124.43. A little lower, at 121.84-122.02 we have the important support area where trying new Dollar longs.

EURGBP: A strong Sterling is still leading de cross path looking for the 0.7105/10 support and map bottom where playing a bounce favored by divergences. Stop below the figure.

EURJPY: Flat figure ranging 137.93 – 141.05 that has to be solved in principle to the upside.

AUD: Despite of the failed attempt against the 0.7818 resistance, high at 0.7848, , the rejection has not been very conclusive. Keep on mind the 0.77 pivot and trend line area to maintain a certain aussie positive tone.

NZD: The kiwi resumes its downward trend just quoting a new 0.6874 low.

No significate references in long term weekly chars until the 0.6560 area.